Evolution of the CATNAT in France

Evolution of the CATNAT in France

Established by French law in the 1980s, this scheme guarantees all French citizens and companies compensation for material damage caused by a natural phenomenon (floods, drought…). The national law requires insurers to include coverage for damage caused in every insurance contract covering property located in French territory (motor fleets, industrial risks, household policies.).

1. The scheme

This public-private scheme is funded by a unique additional premium rate applied to all property contracts, reflecting the principle of solidarity since all policyholders contribute to financing regardless of their risk exposure. The scheme is reinsured by the French public reinsurer (CCR) offering unlimited cover to companies and backed by state guarantee.

In addition to this scheme:

- Each French insurance company can be reinsured by the CCR for these risks.

- In counterpart, insurers transfer these additional premiums to the CCR (totally or partially).

- The French Government provides a guarantee to the CCR to ensure payment of these claims.

However, carriers are concerned about the scheme’s financing, which is threatened by expected cost increases. The total cost of damage caused by natural disasters on French soil was €10 billion in 2022 and €6,5 billion in 2023 – both figures far above the €3,7 billion annual average between 2010 and 2019. In response, the French government in January 2025 will increase its additional premium charged on property damage policies to 20% from 12% and on motor policies for the CASCO part to 9% from 6%.

2. New rates updated from January the 1st, 2025

The 28th of December, 2023, the French Government announced the increase of rates regarding the CATNAT from January the 1st, 2025.

- For all non-life policies (commercial & residential) from 12% to 20%.

- For all motor insurance (theft and fire) from 6% to 9%.

3. The reasons of this increase

The purpose of this increase is to ensure the long-term serenity of natural disaster compensation schemes financed by these contributions.

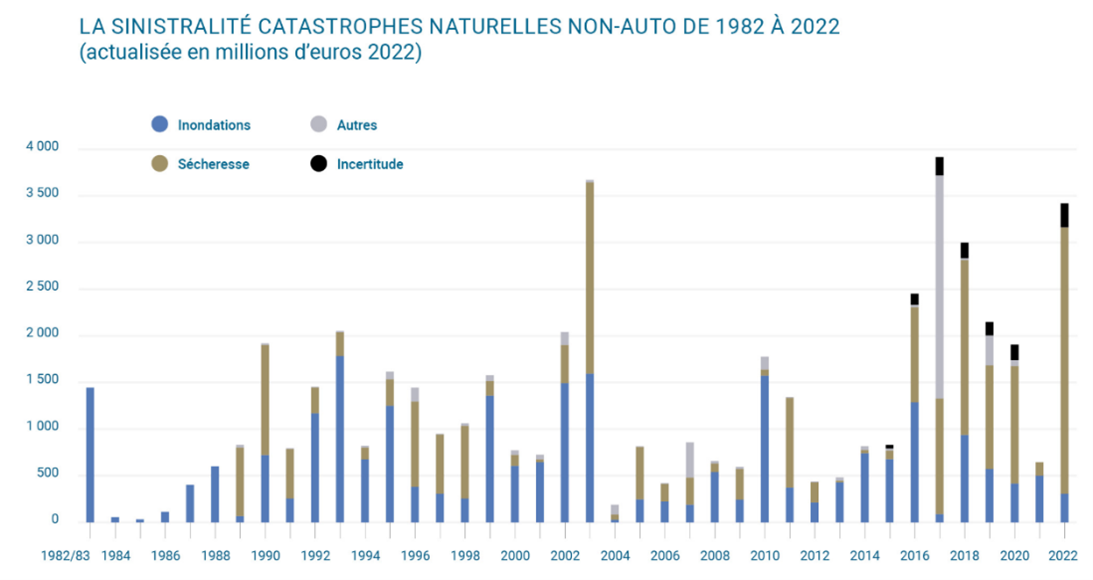

This is taking place against a backdrop of a structural growth of the frequency and intensity of natural disasters (droughts and floods especially) as illustrated in the graph below:

- Annual average between 1982 – 2022 > 1.2Bn EUR

- Annual average between 2016 – 2022 > 2.5Bn EUR

Non-auto natural disaster claims from 1982 to 2022 (updated in millions of euros 2022)

For information, the CATNAT surcharge rate has not been revalued for 25 years. Despite of the total paid amount of 1.88Bn EUR in 2022 (including 1 bn EUR paid by individual policies), the scheme has been in deficit since 2016.

The cumulative deficit between 2025 – 2019 is 1 billion euros, with a deficit of 439 million euros in 2017. So, the CCR reserves have thus fallen by 30% over the last 5 years.